Small, independent insurance agencies might be intimidated by data analytics and believe that it is too sophisticated or expensive for their businesses. However, data analytics is simply an assessment of the data that they collect, allowing them to make better business decisions. There are several measures that you can take to use data analytics to enhance your agency’s performance.

-

Understand Your Data

Before you start using data-analytics software, spend some time understanding your data. You can do this by making a spreadsheet with the details that you have gathered from your clients such as their home and business addresses, birthdates, industries, store locations and number of workers.

-

Determine Your Goals

There are a number of goals you could achieve from understanding your data. The following are examples:

- Which type of client is most profitable?

- Are commercial or personal lines more profitable?

- What is our retention rate by segment?

- Which marketing efforts best target new clients?

- What type of people make the best referral source?

-

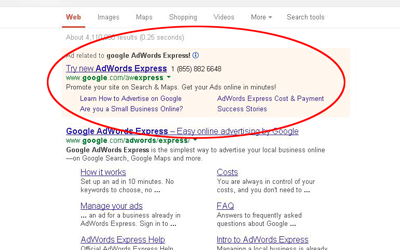

Find The Right Tools

There are a number of tools on the market to help you analyze your data, or you may be able to use the data-analytics tool or feature included in your agency-management system. If it doesn’t have one, you could talk to the insurance companies that you do business with and request assistance or even a partnership.

-

Handling Data Volume

Problems can occur when there is so much data that it is hard to determine what is the most relevant. This issue is made worse when the method of data storage that you use cannot be easily retrieved and reviewed. However, sophisticated software is available to identify relationships and patterns in data. The best way to get through this is to not worry about the complex algorithms and terms. Just remember that using the data is a path to making better decisions for your agency.

The more details that you know about your existing and potential clients, the better you can assist them. Data analysis gives you the details that you need to allow you to drive growth and yield better performance out of your independent insurance agency.