Which of your commercial clients need cyber coverage? All of them.

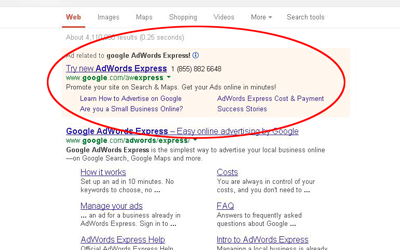

Any organization that has a computer network, handles confidential information, or collects and transacts with personal identifiable information is at risk of a data breach. This exposure has the potential to pose a significant financial threat to any business or entity involved. Traditional insurance policies such as General Liability, Directors & Officers Liability, and Crime Coverage typically do not provide protection against a data breach.

A recent report by the Ponemon Institute and IBM Security indicate that the financial impact of cybercrime on a business can be devastating. Here are some findings from the report.

- The average cost of a data breach in the U.S. is $9.44 million.

- 83 percent of organizations have had more than one breach.

- The average ransomware attack costs $4.54 million – and that does not include the cost of the ransom itself.

- Businesses save an average of $3.05 million by fully deploying security artificial intelligence (AI) and automation.

No matter the industry, your commercial clients need to secure appropriate cyber liability coverage. MiniCo’s Cyber Insurance program addresses data breach, cyber extortion, business interruption, and more. Get a quote today.*

*Coverage available in most states.