Consumers are becoming increasingly frustrated dealing with customer service issues at large corporations. We’ve all had the rather lengthy experience of trying to get to a real person on the phone. Unlike impersonal big businesses, independent insurance agencies have an advantage: While offering similar services, local agencies can deliver more personalized service.

Cultivate Unique Customer Relationships

Beyond competing on price, owners and managers of small insurance agencies are better able to build lasting relationships. So it is important to take the time to cultivate individualized relationships with clients. Each customer has their own individual needs, and these often extend beyond just their requirements for insurance. For example, some clients might feel more comfortable discussing insurance after a chat about family. Others may prefer to get down to business and simply talk about the details of the quote.

Place A Premium On Real Interactions

Unlike larger companies, small agencies can use real-world interactions to their advantage. Agents should meet face to face when possible. At the same time, even a local phone call can have more perceived value than a conversation from a distant, noisy call center.

Make Strengths Out Of Weaknesses

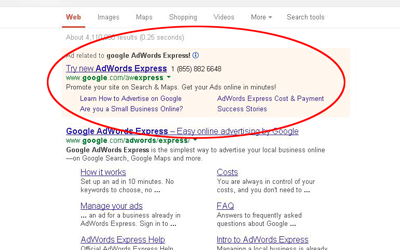

With affordable and powerful technology, it’s more possible than ever for smaller independent agencies to compete with larger companies, so it’s important for local agencies to take advantage of that fact. Use online meeting software and consider a live chat on your website. Some agencies are even building their own unique mobile apps.