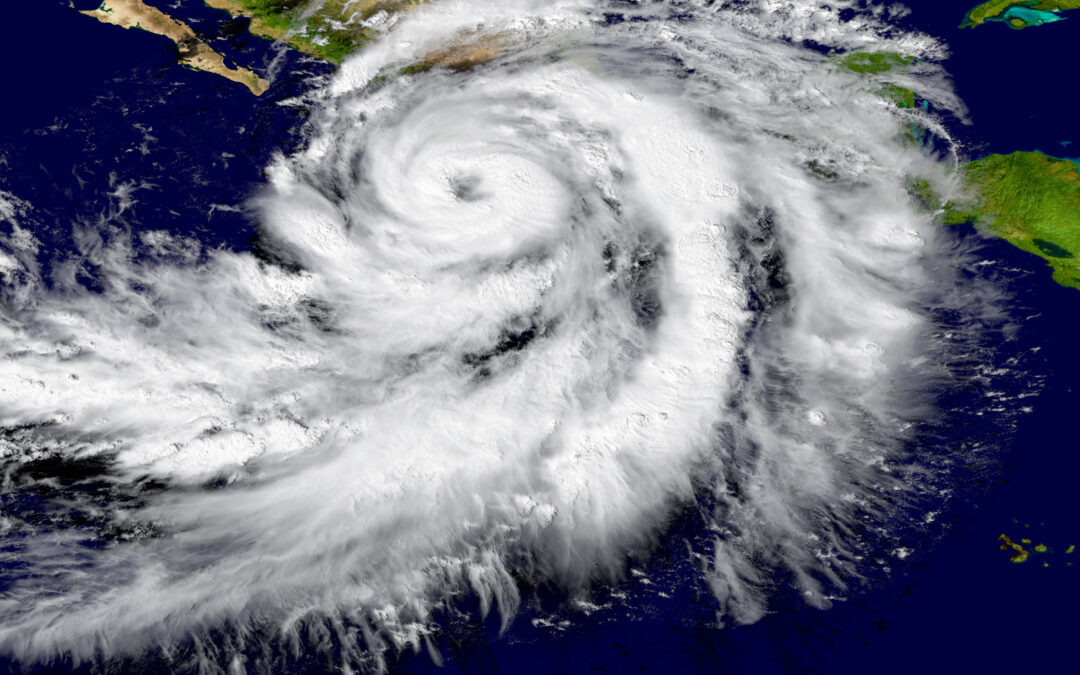

Nature has a way of reminding us of its immense power, often showcasing its strength through hailstorms and powerful winds. These events can leave us in awe at the raw power of nature, but the aftermath can be devastating, leaving behind a landscape marked by damage and uncertainty.

In the midst of the chaos of a severe hailstorm, businesses, homes, vehicles, and other property can be damaged and destroyed. The latest estimates indicate that storm damage in the U.S. has already resulted in billions of dollars in insured losses at midyear, and is on course to exceed $30 billion for the year.

Thankfully, specialized insurance policies are able to act as a safeguard that protects property owners from the overwhelming financial burdens that come hand-in-hand with hail and wind damage.

The Scope of Hail and Wind Damage

Examining the destructive potential of extreme weather, particularly wind and hail, helps to underline the importance of taking preventive measures to protect property and securing appropriate insurance coverage to protect financial interests. The most common types of damage resulting from severe hail and wind events are:

- Property Damage: Powerful winds exert immense pressure on buildings and can cause roofs to collapse or walls to cave in. Temporary structures such as portable office buildings may be overturned or mangled. In addition, hail combined with fast-moving wind can shatter windows and damage roofs, walls, gates, and outdoor furnishings.

- Vehicle Damage: If you have ever driven by a car dealership advertising a storm sale, you’ve seen what hail and wind can do to a vehicle. Hailstorms are well known for breaking windshields, causing roof and body damage, and even overturning vehicles entirely.

- Falling Trees: Wind is a key factor in the destructive potential of a storm. Wind speeds of 40 mph can break tree limbs, and 55 mph winds can send trees crashing down. The costs really start to increase when those trees land on nearby buildings, vehicles, and other structures.

- Power Outages: High winds can damage electrical lines and other equipment, leading to power outages. For commercial businesses that rely heavily on electricity for the production of goods, a power outage can negatively impact revenues due to lost production time, lost business, spoilage, and equipment damage.

2023 Is Proving to Be a “Hail” of a Year

Looking at data from January through June, it’s clear that 2023 has been a remarkable year for hailstorms. Steve Bowen, chief science officer at Gallagher Re, strongly emphasized, “If there ever was a year to highlight how little respect hail gets as a significant damage cost driver, 2023 is certainly it.”

Even the geographical considerations have shifted. Where meteorologists and risk analysts once focused on Hail Alley, a region stretching from Wyoming to Texas, hail is now a risk nationwide. The sheer frequency and intensity of property damage resulting from severe hailstorms and the accompanying financial impact on insurance carriers has drawn increasing attention to this climate trend. According to data from the National Oceanic and Atmospheric Administration (NOAA), the number of billion-dollar hailstorms in the first half of 2023 already equals the total number of similar events the previous year.

Insurance as a Vital Safety Net

The staggering financial cost of severe weather puts new urgency on the importance of obtaining the appropriate insurance coverage, especially for commercial properties that reside in areas prone to hailstorms. Critical coverages for commercial properties include property and liability, building ordinance, and business income. With the ongoing hard insurance market, it’s more important than ever to establish appropriate building valuation, review deductibles, and adjust coverage limits to provide appropriate protection against potentially catastrophic out-of-pocket financial exposures.

A specialized insurance solution to address wind and hail losses should also be a consideration. MiniCo’s exclusive Wind/Hail Deductible Buyback program enables policyholders to buy-down high percentage deductibles for wind and hail to as little as 1% or a specific dollar amount. The program is available nationwide for commercial properties. Contact us to get a quote today.